Digital securities

Digital securities, or security tokens, represent digitized real-world assets or financial instruments, such as stocks, bonds, or real estate. These tokens are issued and managed on a blockchain like the Liquid Network and are subject to financial regulations and often give investors rights, such as dividends, profit sharing, or voting.

By digitizing (tokenizing) assets, digital securities can offer increased liquidity, fractional ownership, and reduced costs, making the investment process more efficient and accessible for a broader range of investors. A small percentage of global capital markets is publicly traded. By democratizing access, the digital securities market could dwarf anything in comparison today.

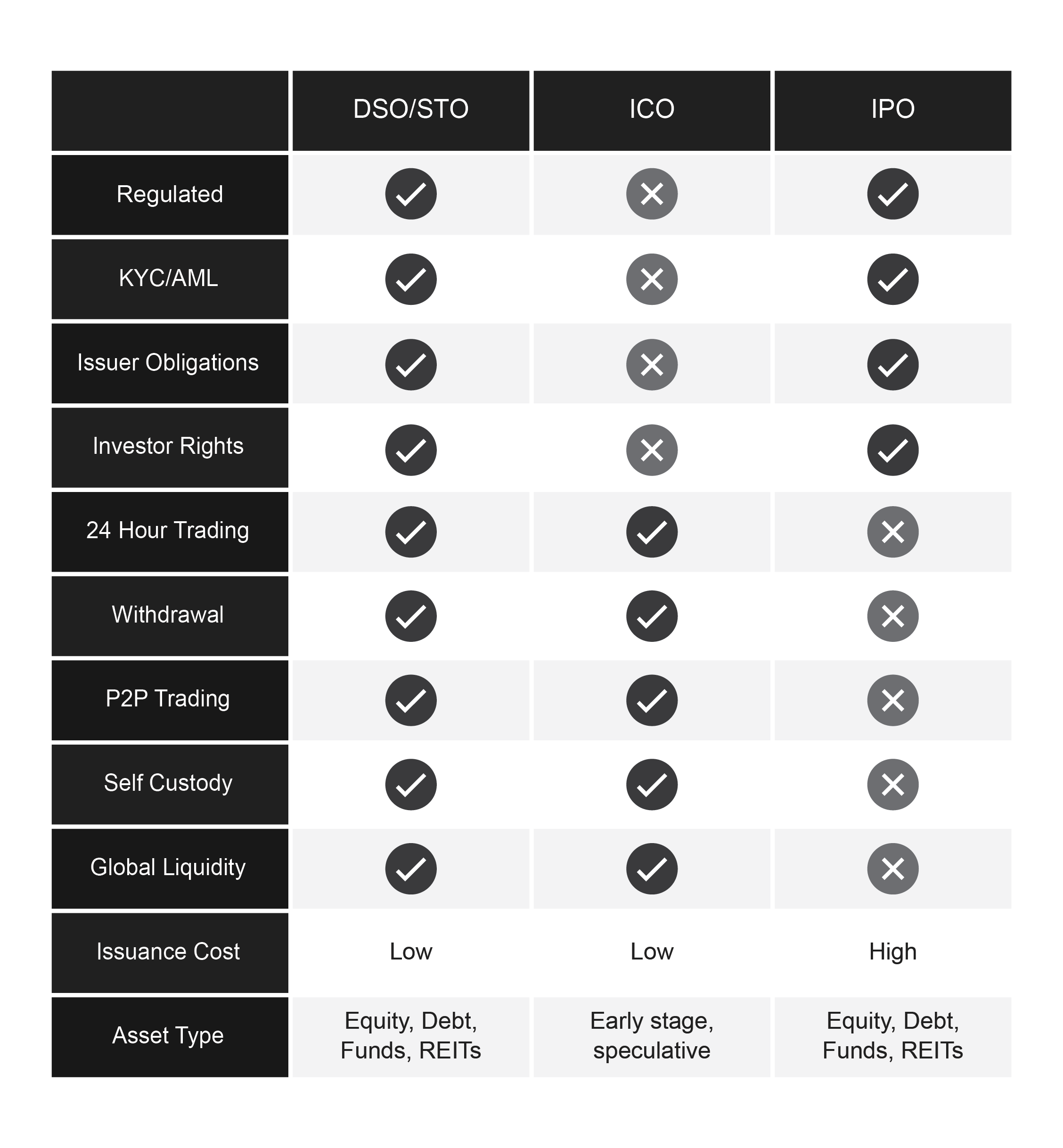

Digital securities offerings (DSOs) or security token offerings (STOs) provide many of the benefits of ICOs but with clearly defined issuer obligations, investor rights, and regulatory oversight.