Real-world assets (RWAs)

Real-world assets, also known as RWAs, are tangible assets with intrinsic value that have been tokenized on a blockchain. This tokenization process involves creating a digital representation of a physical asset, like real estate, commodities, and debt instruments.

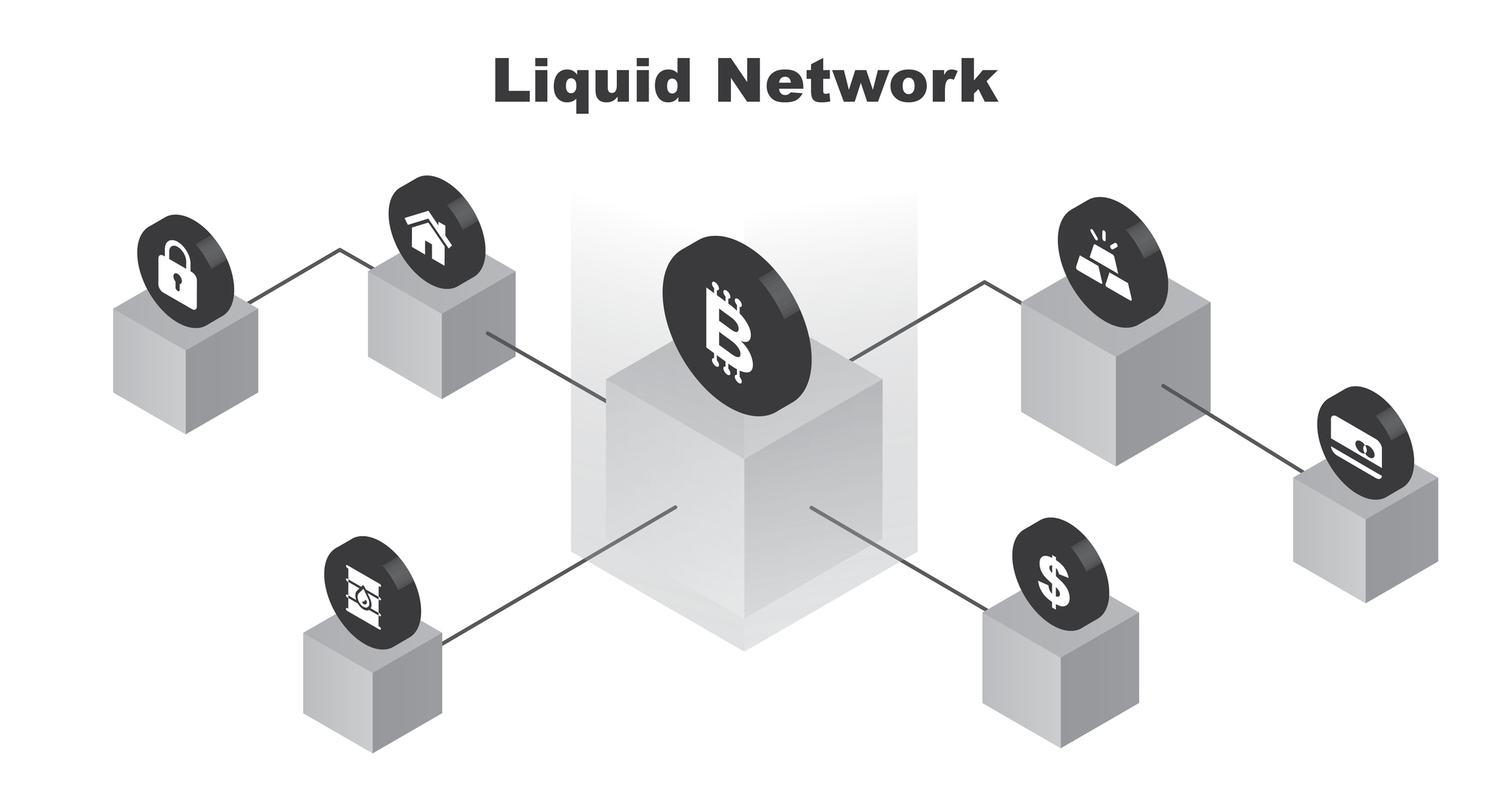

Tokenizing (or digitizing) assets allows for ownership, trading, and management on a blockchain, enabling increased liquidity, fractional ownership, and self-custody for greater utility.

An example of RWAs in the Bitcoin space is a promissory note, which is a type of debt instrument commonly used as collateral in emerging economies. In this particular instance, each note is cryptographically linked to a unique digital asset on the Liquid Network. This enables the borrower to endorse the note to a lender and transfer the associated token to a new owner, mitigating the risk of rehypothecation.